Your tax dollars, your choice!

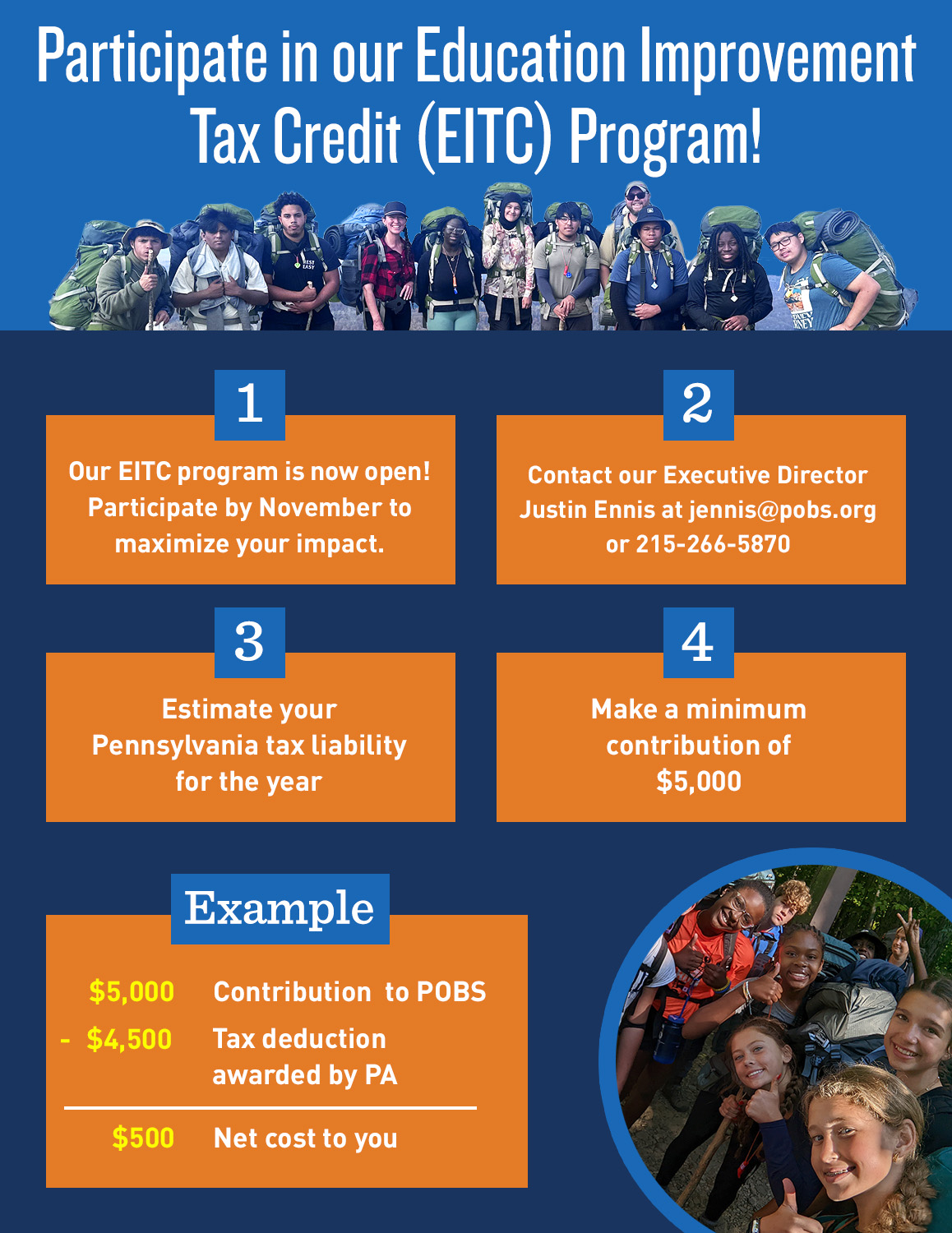

Through participation in the Pennsylvania Educational Improvement Tax Credit (EITC), you can earn significant state tax credits while changing the lives of our students. Pennsylvania's EITC program is an incentive designed to channel greater financial support to educational improvement organizations (EIO). The Philadelphia Outward Bound School (POBS) is on the Commonwealth’s approved list and eligible to receive such donations.

It’s an easy process. Donors send their donation to an intermediary called a special purpose entity (SPE). The SPE then sends the funds to POBS and issues you a credit for up to 90% of your state tax bill.

Your support of POBS through the EITC program will bolster our efforts to make our experiential education programs available to more students, regardless of their financial circumstances.

FREQUENTLY ASKED QUESTIONS

Who is eligible? Participants must have Pennsylvania-source income. Individuals who work for companies that do not conduct business in the Commonwealth or who have income from out-of-state sources should consult with an accountant. (Not sure if you qualify? Take this quiz!)

What if I file a joint return? The tax credit is applied to offset a joint tax liability,so only one spouse needs to apply. The enrolling spouse needs to meet the eligibility requirement but does not need to be the primary income earner.

Does the tax credit carryover? No, tax credits must be used in the year that they are earned, so donors should not give more than the PA tax liability which is reported on Line 12 of the PA Form 40.

How do I get started? Contact us at [email protected].